Sustainability

Sustainability Governance

Commitment to sustainability is anchored at the highest levels of Minor. Our efforts to embed sustainability in all business groups continue to receive strong support from the Board of Directors and senior management.

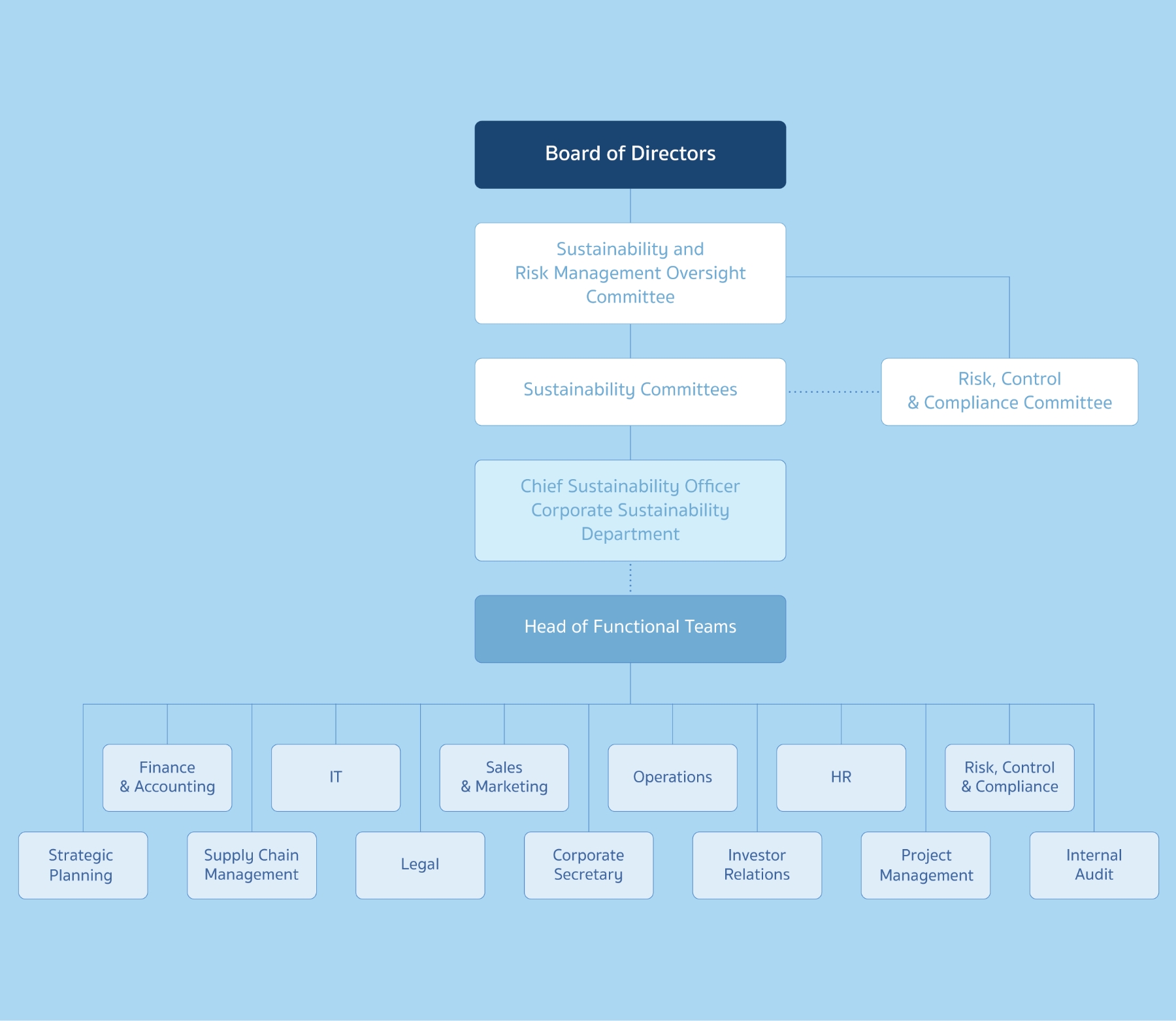

Minor Sustainability Governance Structure & Roles

Minor acknowledges that robust governance, transparent and responsible business conduct, and the seamless integration of sustainability into all aspects of its operations are crucial for building resilience and achieving success. Our efforts to embed sustainability in all business groups receive strong support from the Board of Directors and senior management. The sustainability strategy is built on the foundation of our vision, Core Values, business strategy, together with dynamic stakeholder engagement, as well as existing and emerging sustainability trends and risks/ opportunities. The Board endorses Minor long-term sustainability goals and rolling 3-Year Sustainability Strategy, which is presented annually, and reviews progress quarterly.

Sustainability and Risk Management Oversight Committee (SRMOC) is established to oversee the Sustainability Committee and the Risk, Control & Compliance Committee. The committee’s role is to assist the Board in its oversight of the company’s strategic activities, policies and practices for sustainability and management of key risks, including strategic, operational, financial, climate, biodiversity, other sustainability-related, and emerging risks, as well as the guidelines, policies, and processes for monitoring and mitigating such risks. This includes identifying opportunities that may arise from such risks. Per Charter, SRMOC shall consist of a minimum of 3 directors. At present, the Committee comprises of 4 directors, 2 of which are independent directors. Details of SRMOC can be found here.

Sustainability Committee was established to oversee the comprehensive sustainability management across all business groups. Its key functions include fostering and reviewing sustainability strategy, setting targets, formulating policies, monitoring performance, and ensuring the accuracy of sustainability information disclosures. The committee, chaired by the Chief Sustainability Officer, is composed of C-Suite officers, senior management of relevant functions from all business groups, and the Corporate Sustainability Department. The Committee meets quarterly to discuss implementation plans, review progress towards sustainability goals, and provide necessary resources. The Corporate Sustainability Department is responsible for developing, updating, and executing company’s sustainability strategy. The team consults with senior management of all business groups and collaborates closely with all business groups to embed sustainability and ensure our sustainability initiatives and practices are aligned with company’s overall strategic direction. The team also facilitates by monitoring and communicating progress of our sustainability initiatives and practices.

The Risk, Control & Compliance Committee meets at least quarterly. The Committee has the responsibility for reviewing overall implementation of risk management across the group to assure that key risks are systematically and effectively identified and managed. This includes sustainability, biodiversity, and climate-related risks and opportunities.

The Chief Executive Officers (CEOs) and Chief Financial Officers (CFOs) of each business groups are responsible for identification of risk, monitoring, and the implementation of risk management measures. The business groups are risk owners and have primary responsibility to promote risk awareness within their operations and effectively managing risks on a day-to-day basis. Furthermore, the business groups are also responsible for identifying their own risk appetite and risk tolerant within their operations and aligning with the broader risk appetite cascaded down to them.